22/05/ · Homepage / Forex Articles Market Execution vs. Prompt Execution. May 22, January 21, by admin. Market Execution vs. Prompt Execution. admin-Forex Articles, Traders, Trading Strategy views. Forex Online traders at all times take into consideration the distinction between Market and Prompt execution. What sort of execution is Instant execution provides greater certainty of pricing than market execution, which may appeal if you are new to Forex trading. However, market execution provides greater certainty of execution and direct market access. Compare brokers with instant execution and those with market execution for more information 15/06/ · Market execution is a type of execution in which the client places an order and specifies only the volume. The bid/ask price of an asset is generated during the process of execution. The main distinction from instant execution is that a broker doesn’t reject client’s request Estimated Reading Time: 3 mins

Market Execution vs Instant Execution - Forex Education

As you probably know, there are two kinds of orders in MetaTrader platform: pending orders and market orders. Pending orders can be limit, stop, or stop-limit in MT5 and will be executed when the price reaches some predefined level. Market orders can be either of instant execution or of market execution.

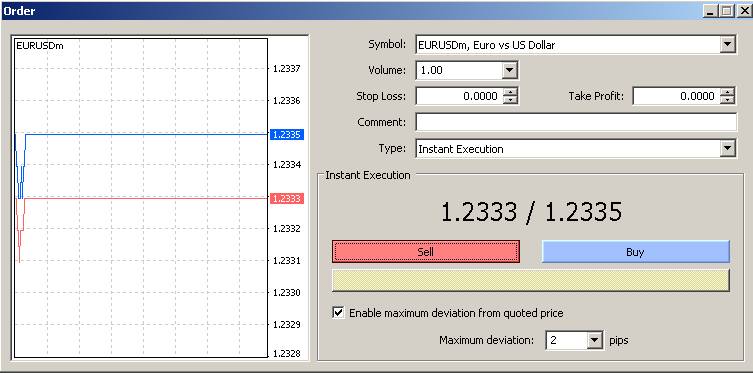

The execution type is set by a Forex broker and cannot be modified by a trader. When instant execution is used, the broker will try to execute your order using the latest price that you have seen in your platform.

Consequently, there is a probability that instant execution vs market execution forex price changes while instant execution vs market execution forex order is processed by the broker. If the change is greater than the deviation parameter specified in the order, the broker will reply with a requote and you can either accept the new price or reject the order execution at instant execution vs market execution forex. The clear advantage of this execution mode is that you can get an order executed at a known desired price.

The disadvantage of instant execution is also evident — you might miss a good trading opportunity when the volatility is high and your broker is sending you requotes one after another. A sample MetaTrader 4 order creation window with instant execution model can be seen below. Note the maximum allowed deviation input field at the bottom:. If your broker is using market execution most ECN brokers are to process orders, instant execution vs market execution forex, your order will open a position at the broker's latest price even when it is different from the one you see in your platform.

The price may actually be the same as the one you see in the platform, or it may be only somewhat different, but sometimes, the difference may get quite serious.

On the one hand, market execution allows you to trade currencies without any sort of requotes. It will result in a much faster execution of your orders.

On the other hand, slippage or deviation can get very big during volatile price changes. Another disadvantage of this type of execution is that brokers that employ it will not allow setting stop-loss and take-profit orders during order opening.

You will have to place a bare order first and then apply your SL and TP according to the price it has been executed at. Below, an example of the MT4 trading dialog shows the market execution model. Note the warning of the possible price difference between the currently displayed price and actual execution price:. It is important to understand that the difference between the two models is, instant execution vs market execution forex, in fact, instant execution vs market execution forex, minuscule and can be experienced only under extreme market conditions.

It might be prudent for most traders to stay away from such situations regardless of their broker's execution type. Getting constant requotes can be as bad for your trading instant execution vs market execution forex as a huge slippage can be. Apparently, there is no such thing as the best type of execution.

You should look at your goals and choose a broker or an account type at your broker if the instant execution vs market execution forex offers account types with both execution methods accordingly. Both execution modes are present in MetaTrader 4 and MetaTrader 5, and there is no difference in how those two versions of the platform handle them.

If you have some questions or wish to share your experience trading Forex with instant or market execution types, join a discussion on our Forex forum.

If you want to get news of the most recent updates to our guides or anything else related to Forex trading, you can subscribe to our monthly newsletter. MT4 Forex Brokers MT5 Forex Brokers PayPal Brokers WebMoney Brokers Oil Trading Brokers Gold Trading Brokers Muslim-Friendly Brokers Web Browser Platform Brokers with CFD Trading ECN Brokers Skrill Brokers Neteller Brokers Bitcoin FX Brokers Cryptocurrency Forex Brokers PAMM Forex Brokers Brokers for US Traders Scalping Forex Brokers Low Spread Brokers Zero Spread Brokers Low Deposit Forex Brokers Micro Forex Brokers With Cent Accounts High Leverage Forex Brokers cTrader Forex Brokers NinjaTrader Forex Brokers UK Forex Brokers ASIC Regulated Forex Brokers Swiss Forex Brokers Canadian Forex Brokers Spread Betting Brokers New Forex Brokers Search Brokers Interviews with Brokers Forex Broker Reviews.

Forex Books for Beginners General Market Books Trading Psychology Money Management Trading Strategy Advanced Forex Trading. Forex Forum Recommended Resources Forex Newsletter.

What Is Forex? Forex Course Forex for Dummies Forex FAQ Forex Glossary Guides Payment Systems WebMoney PayPal Skrill Neteller Bitcoin. Contact Webmaster Forex Advertising Risk of Loss Terms of Service. Advertisements: RoboForex — Over 8, Stocks and ETFs. Please disable AdBlock or whitelist EarnForex. Thank you! EarnForex Education Guides. Instant Execution When instant execution is used, the broker will try to execute your order using the latest price that you have seen in your platform.

Note the maximum allowed deviation input field at the bottom: Market Execution If your broker is using market execution most ECN brokers are to process orders, your order will open a position at the broker's latest price even when it is different from the one you see in your platform. Note the warning of the possible price difference between the currently displayed price and actual execution price: Conclusion It is important to understand that the difference between the two models is, in fact, minuscule and can be experienced only under extreme market conditions.

The Reason Why I Only Do Market Execution Trades

, time: 11:00Instant Execution vs. Market Execution

During the processing, the price may change – decrease or rise. At Instant Execution, the broker sends a requote (repeated request) with new quotes. The trader decides whether he wants to buy currency at this price or not. At Market Execution, a transaction is executed immediately at a 22/05/ · Homepage / Forex Articles Market Execution vs. Prompt Execution. May 22, January 21, by admin. Market Execution vs. Prompt Execution. admin-Forex Articles, Traders, Trading Strategy views. Forex Online traders at all times take into consideration the distinction between Market and Prompt execution. What sort of execution is Instant Execution is a feature of a Dealing Desk broker. Market Execution is offered by No Dealling Desk brokers. Price quotes come from Broker. Price quotes originate in the Market. Forex Broker acts as a Marker Marker and "makes market" by creating own prices. Forex Broker receives prices from Liquidity Providers

No comments:

Post a Comment