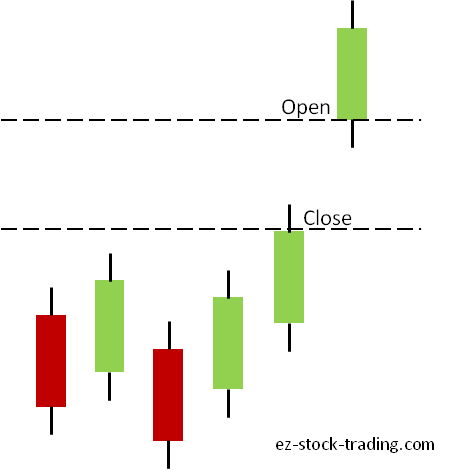

08/09/ · If the open of the day is lower than the close of yesterday, then the market gapped down. That applies to markets that close every day. If the open of the day is higher than the close of yesterday, then the market gapped up. If the open of the day is lower than the A gap is an area on a chart where the price of a currency pair moves sharply up or down, with little or no trading in between. Gaps do appear in the forex market, but they are significantly less common than in other markets because currencies traded 24 hours a day, five days a week 26/12/ · Gaps are identified individually as a Down Gap and an Up Gap. A down gap is formed with the opening price is lower than the closing price of the previous day. An up gap is formed with the opening price is higher than the closing price of the previous day/5(16)

Gap Trading in Forex - definition, Types of Gaps, strategies, rules

A gap is an area on a chart where the price of a currency pair moves sharply up or down, with little or no trading in between. Gaps can happen moving up or moving down.

In the forex market, gaps primarily occur over the weekend because it is the only time the forex market closes. Gaps may also occur on very short timeframes such as a gap up down in forex chart or immediately following a major news announcement. In Forex gaps are not very common and they usually only occur at market open on Sundays, gap up down in forex. The concept behind gap trading is that price will always try to fill the gap.

This means the stock price opened higher than it closed the day before, thereby leaving a gap. The gap and go strategy is when a stock gaps up from the previous days close price. Sunday night is gap up down in forex only time of the trading week, when gaps occur regularly for currency pairs.

Therefore, Sunday is not the best day to trade the Forex market. Judging by the lack of activity on the market, most traders follow this advice. Currency trading is unique because of its hours of operation. The week begins at 5 p.

EST on Sunday and runs until 5 p. on Friday. Not all hours of the day are equally good for trading. The best time to trade is when the market is most active. Forex market hours are the schedule by which forex market participants can buy, sell, exchange and speculate on currencies all around the world. The forex market is open 24 hours a day during weekday hours, but closed on weekends. That could in turn signal the start of a new trend if the gap up open has occurred post a prolonged period of consolidation.

Gap-down: When the price of a financial instrument opens lower than the previous trading day it is gap-down. Gap-downs occur when there is a change in investor sentiments. Market gaps are opportunities disguised as voids. For example, Netflix has filled several market gaps over the years, gap up down in forex. This is considered a bullish signal. A runaway gap, typically seen on charts, occurs when trading activity skips sequential price points, usually driven by intense investor interest.

In other words, there was no trading, defined as an exchange of ownership in a security, between the price point where the runaway gap began and where it ended. Skip to content Trading Currencies About Forex. About Forex 0. Is the forex market open on holidays? The Forex Market is open every weekday.

Why do gap up down in forex companies use the foreign exchange market? To diversify their income from. Does FNB Bank allow forex trading? FNB has been globally recognised as the Best.

How will debit card withdrawals be processed? Debit card withdrawals is limited to the. Trading Currencies About Forex, gap up down in forex.

How To Trade Gaps Like A Pro (Original English Version)

, time: 40:53

A gap is an area on a chart where the price of a currency pair moves sharply up or down, with little or no trading in between. Gaps do appear in the forex market, but they are significantly less common than in other markets because currencies traded 24 hours a day, five days a week 26/12/ · Gaps are identified individually as a Down Gap and an Up Gap. A down gap is formed with the opening price is lower than the closing price of the previous day. An up gap is formed with the opening price is higher than the closing price of the previous day/5(16) 08/09/ · If the open of the day is lower than the close of yesterday, then the market gapped down. That applies to markets that close every day. If the open of the day is higher than the close of yesterday, then the market gapped up. If the open of the day is lower than the

No comments:

Post a Comment