The inContact service sends you a message via SMS or email each time a transaction (above TZS18,) is carried out on any of your FNB accounts. What you need to know You will only receive your inContact messages for transactions over TZS18,; You will only receive messages for transactions on accounts which belong to you 19/04/ · PayPal offers the ability fnb forex bop codes receive payments in many currencies. If you have non-US Dollars e. If you have multiple non-US Dollar currencies in your PayPal wallet, funds will be withdrawn and converted into US Dollars in order of the primary currency blogger.comted Reading Time: 11 mins 13/09/ · MoneyGram from FNB is accessible via the FNB mobile app, at an FNB ATM, in-branch, or by dialling **#. The bank charges its own set of fixed fees and uses MoneyGram's forex rates (which are usually better than FNB's)

FNB International Transfers: Fees, Forex Rates, Alternatives, and More

A writer at Monito, Byron possesses a keen interest in the intersection of personal finance and technology. A former journalist, he strives to bring complex information to life in a way that can be widely understood and appreciated.

Links on this page may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors, forex payment received fnb. One of the largest and most established multinational banks that call South Africa home, First National Bank FNB offers a wide range of retail, business, and investment services to customers in South Africa and across southern and central Africa.

While the bank provides excellent, secure, and affordable banking solutions to everyday customers, when it comes to international money transfers in particular, FNB can be extremely pricey. When making an outgoing payment from South Africa, forex payment received fnb, FNB customers pay a hefty commission fee combined with a poor exchange rate margin, leaving between When sending an international payment online either through your Online Banking or FNB Banking Appthe following costs will apply per transaction:.

In most cases, FNB international payments are processed as international wire transfers. This means that, forex payment received fnb, as a customer, you'll need to use your online or mobile banking account to instruct a transfer, and FNB will wire your funds over the SWIFT network to reach its destination in a foreign country and currency.

Alternatively, FNB customers can also send money internally through FNB's partnership with MoneyGram — a feature that's available via mobile app, SMS banking, in-branch, or over the ATM. FNB international transfer fees are levied through a combination of commissions and fixed fees per transaction.

For transfer instructions via online or mobile banking, forex payment received fnb, these fees are the following:, forex payment received fnb. On the other hand, for transfer instructions in-person or over the phone, the fees are similar, albeit with much steeper maximum and minimum fee caps. They are as follows:. In addition to the mandatory fees highlighted above, you may meet other fees still when sending money abroad with FNB.

Depending on your individual circumstances, these fees could include:. If you're asked to choose between 'SHA,' 'BEN,' forex payment received fnb 'OUR,' we recommend avoiding 'OUR' payments wherever possible. These instructions can open the door to third-party banks levying further fees from you long after the transfer has been sent.

In addition to standard wire transfers, MoneyGram from FNB is an alternative method for FNB customers to send money internationally. The service is primarily geared toward cash pick-up services, although MoneyGram — the second largest currency exchange company in the world — also processes bank forex payment received fnb and mobile wallet payments too. The bank charges its own set of fixed fees and uses MoneyGram's forex rates which are usually better than FNB's.

These fixed fees are as follows:. In addition to the costs outlined above, FNB will also include another less transparent fee into your transfer. These fees, known as exchange rate marginsare charged when banks or other currency exchange providers offer poorer exchange rates than the "real" exchange called the mid-market exchange ratethereby making a small profit on every forex payment received fnb converted into a foreign currency.

While FNB forex margins may not appear to be very high typically ranging between 1. It's worth noting that — as with other South African banks — FNB charges lower exchange rate margins on the three major world currencies i.

the British pound, US dollar, and the Euro than it forex payment received fnb on less-traded world currencies. What's more, currencies that are pegged in value to the South African rand i. the Namibian dollar, the Lesotho loti, and the Swazi lilangeni have no exchange rate margins at all with FNB, and as a customer sending to these countries you'll be able to dodge one of the biggest fees in the international money transfer world entirely! With both the service fees and the exchange rate margin fees taken into account, it becomes obvious that the cost of international payments with FNB can be exorbitant.

Suppose, for example, you were to use FNB for a R5, After you'd paid R Contrast this to making the same transfer with Skrilla London-based money transfer specialist available to South Africans and the cheapest on our comparison engine for this transfer at the time of writing. With Skrill, you'd pay no service fees and an exchange rate that's better than the mid-market by 0.

This would get your friend Ksh37, To find out more about how FNB breaks down its fees on international payments, take a look at the graph below for several major currencies:.

While FNB makes receiving money from overseas in South Africa very easy, it's nevertheless forex payment received fnb as expensive as the other way around. To receive a wire transfer from an international bank via SWIFT, FNB will charge the following fees:. Similarly to the FNB international transfer fees outlined earlier, the fee will be higher still if you'd like to receive money from overseas in-person or over the phone.

All things considered, FNB is indeed a world-class partner for your everyday banking needs, and as a customer, you'll be able to rely on a secure and distinguished institution to help you with a wide range of services.

As such, if you're happy to pay a little bit extra for the comfort and security of making an international money transfer with a bank such as FNB, then we'd recommend you stick with them, as they'll most likely give you everything you need, forex payment received fnb.

However, if you're somebody who values saving money on these oftentimes expensive services, then FNB may not be the best choice for you.

Instead, we forex payment received fnb that you explore your options on the many money transfer specialist services out there to see which one will offer you the best rates.

To get the job done, run a search on Monito's comparison engine to find real-time rates and fees with all major providers available to South Africans. To get a better picture of how FNB's foreign exchange services weigh up against a few of the specialist money transfer services mentioned above, forex payment received fnb, take a look at how the costs weigh up on a R10, FNB international money transfers made via SWIFT typically take between one and three working days to arrive in the beneficiary's bank account abroad.

However, these types of transfers can sometimes take longer still, especially if the beneficiary's bank is located in a less-served country. FNB transfers with MoneyGram, forex payment received fnb the other hand, typically take between 10 minutes and two working days, depending on the chosen pay-out option. As a major world-class banking institution, FNB most certainly does currency exchange. These services range from international wire transfers as we explored in this articleto multicurrency bank accounts and travel cards, to buying foreign banknotes, as well as to currency exchange with MoneyGram and PayPal.

While most of this you can do using your FNB online banking, you can also go to your bank branch. To see which FNB branches in South Africa offer currency exchange services, click here. To see the most up-to-date figure, visit the bank's foreign exchange rates page and click on the 'View rates' button. Although it's based out of South Africa and a vast majority of its customers are Forex payment received fnb African, FNB has operations in neighbouring Botswana and Namibia, making it an international bank, strictly speaking.

What's more, FNB also has subsidiaries in many countries across Africa, including in Tanzania, Zambia, and Mozambique. To transfer money from FNB South Africa to FNB Namibia, you'll need to do make an international bank transfer just as you would to a bank in any other country. This is because FNB Namibia, despite being a subsidiary of FNB South Africa, remains functionally separate. To transfer money from FNB South Africa to FNB Namibia, you'll therefore need to do the following:.

After facing this frustration themselves back inco-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. FNB International Payments: Transfer Fees, Forex Rates, Alternatives, and Monito's Recommendation.

Byron Mühlberg Forex payment received fnb. Affiliate disclosure. FNB International Transfer Fees When sending an international payment online either through your Online Banking or FNB Banking Appthe following costs will apply per transaction: A 0. R, max. A R flat fee, forex payment received fnb. Compare FNB's Forex Rates.

What You'll Find in This Guide What are FNB's international transfer fees? scroll down What are FNB's forex rates? How expensive are FNB international payments? Receiving money from overseas in South Africa FNB scroll down Is FNB right for you?

Other frequently asked questions about FNB international payments scroll down. FNB International Transfer Fees In most cases, FNB international payments forex payment received fnb processed as international wire transfers. FNB Charges for International Transfers FNB international transfer fees are levied through a combination of commissions and fixed fees per transaction.

For transfer instructions via online or mobile banking, these fees are the following: A 0, forex payment received fnb. They are as follows: A 0.

FNB International Transfers: Other Fees to Anticipate In addition to the mandatory fees highlighted above, you may meet other fees still when sending money abroad with FNB, forex payment received fnb. Depending on your individual circumstances, these fees could include: A R This fee is in addition to the fixed fees outlined above, and in place of the exchange rate margin fees that you'll be skipping when sending to these currencies.

A correspondent bank fee that can range anywhere between R Avoid 'OUR' Forex payment received fnb If you're asked to choose between 'SHA,' 'BEN,' and 'OUR,' we recommend avoiding 'OUR' payments wherever possible.

FNB MoneyGram Fees In addition to standard wire transfers, MoneyGram from FNB is an alternative method for FNB customers to send money internationally. Very Small Small Medium Large. Compare FNB Forex Fees. FNB Forex Rates: Beware The Hidden Fees In addition to the costs outlined above, FNB will also include another less transparent fee into your transfer. The Costs Combined With both the service fees and the exchange rate margin fees taken into account, it becomes obvious that the cost of international payments with FNB can be exorbitant.

USD to the US INR to India GBP to the UK AUD to Australia. Country from Select a country, forex payment received fnb. Country to Select a country. You send, forex payment received fnb.

Receiving Money From Overseas in South Africa With FNB While FNB makes receiving money from overseas in South Africa very easy, it's nevertheless almost as expensive as the other way around.

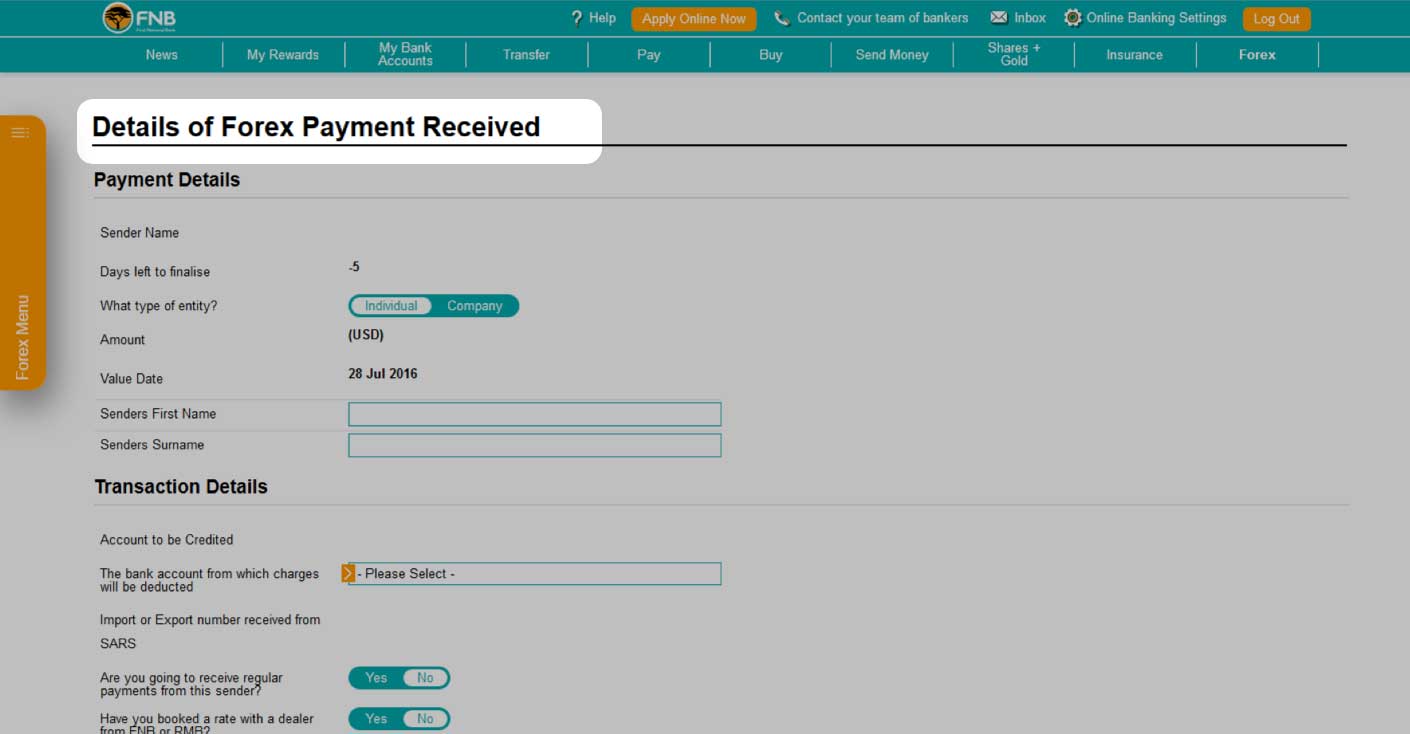

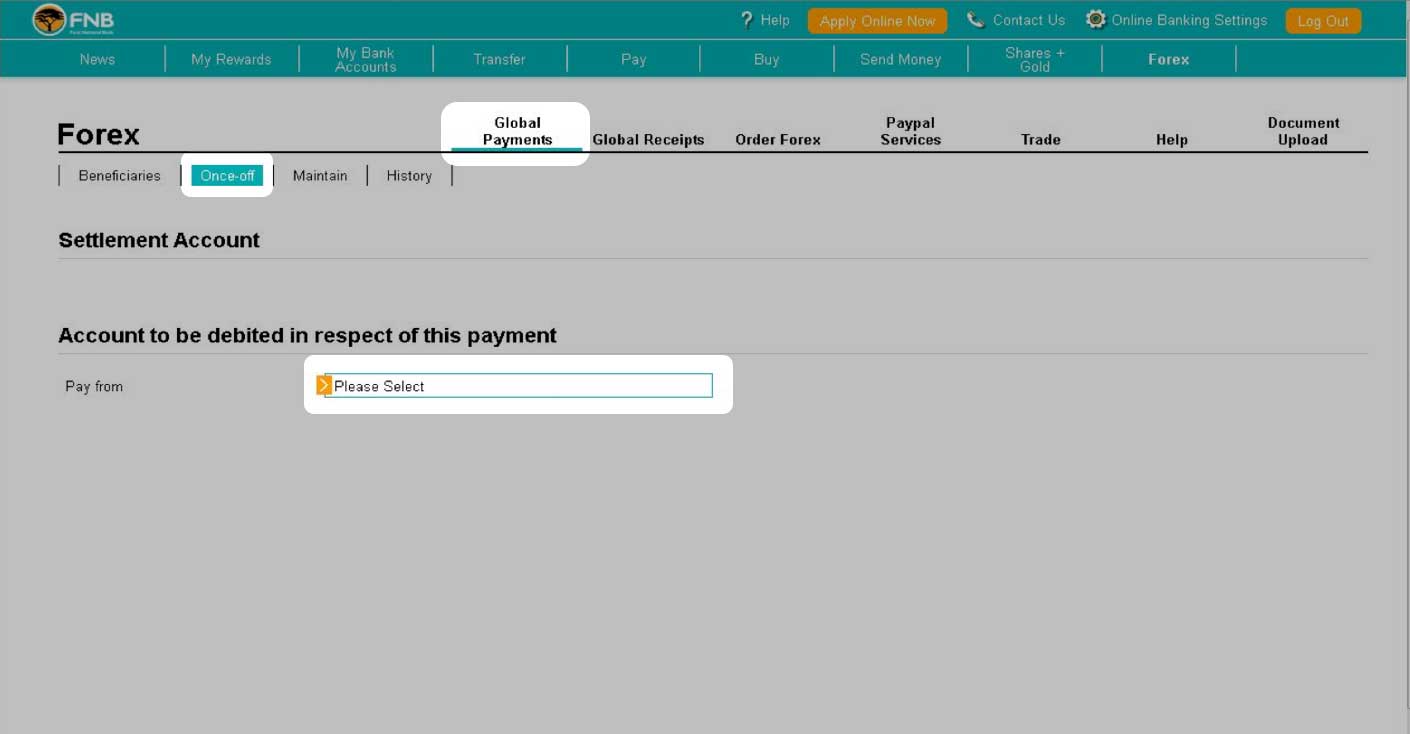

To receive a wire transfer from an international bank via SWIFT, FNB will charge the following fees: A 0. Is FNB Right For You? How Do FNB International Transfers Compare? Frequently Asked Questions About FNB International Money Transfers How long does an international transfer take with FNB? To send money as a wire transfer with FNB, you'll need to do the following: Login to your FNB online banking profile; Select 'Forex' from the tabs at the top of the interface; Select the 'Global Payments' option; Specify whether your payment is once-off or recurring; Add all your recipient's banking details; Enter the BoP code for your transfer; Instruct the transfer.

FNB Forex Online

, time: 1:33Global payments - Forex - FNB

11/05/ · As an alternative method to receive funds please make use of the our global payment methods or Paypal, going forward. For more info on Forex and PayPal, click on the Forex tab in the FNB Estimated Reading Time: 6 mins 05/07/ · Fnb forex payment receipts codes. code Description Imports: Advance payments 01 Advance payment –excl capital goods and mining resources 02 Advance payment –Capital Goods 03 Advance payment – Gold 04 Advance payment – Platinum 05 Advance payment – Crude Oil 06 Receive money abroad using the FNB App on your smartphone Step 1: Login to your Online Banking profile. Step 2: Select the 'Forex' tab, then click 'Global Payments'. Step 3: Pick between a 'Once-off Global Payment' or the 'Recipients' list. Step 4: Provide all the information about the Global Payment. Step 5: Select the reason for the payment

No comments:

Post a Comment