26/04/ · How to use the strategy. First, you have to identify where the trend is going in the H1 timeframe. Drop down to the M15 timeframe and draw your supply and demand zones. Now go to the M1 Timeframe. On the M1 timeframe wait for the EMAs in the RSI to get to the Overbought range. Also, wait for the EMA in the RSI to get to the Overbought zone This Dark secret of Forex trading learn the Deep and hidden secrets of Forex trading how to trade boom and crash of successful Forex traders, strategy, Forex trading 11/08/ · For instance, in currency pair trade, using a lot size of for a $ account is a good risk management decision. However, trading boom and crash with a lot size of is a difficult adventure that will demand more than pips before a trader gets a profit of $1. For that reason, blogger.com upgraded the lowest lot size of the market from Estimated Reading Time: 5 mins

7Bforex - % Boom Bonus

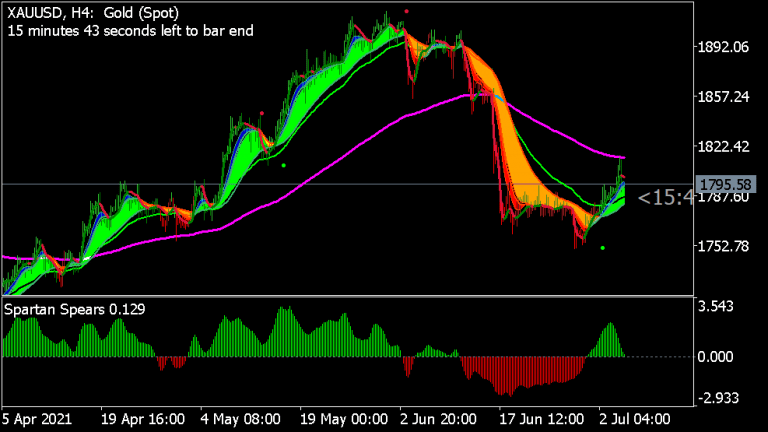

Join Our Telegram Group Chat - CLICK HERE. Choose Moving Average: Period 13Shift 0Method Big boom forex traders Apply to Close Period 50Shift 0big boom forex traders, Method Exponential Apply to CloseStyle 2 Pixel ; PeriodShift 0Method Exponential Apply to CloseStyle 2Pixel. Period 1 : Apply to Close Style 3Pixel Levels: 10 Extremely Oversold 20 Oversold 50 Wait 80 Overbought 90 Extremely Overbought Style 1 Pixel.

First, you have to identify where the trend is going in the H1 timeframe. Drop down to the M15 timeframe and draw your supply and demand zones. Now go to the M1 Timeframe. On the M1 timeframe wait for the EMAs in the RSI to get to the Overbought range. Also, wait for the EMA in the RSI to get to the Overbought zone.

The EMAs on the chart also work and support and resistance. When the 50 EMA crosses the EMA going to the downside it indicates a strong signal to start selling given that our conditions on the RSI have also been met. After a spike comes wait for the price to pull back to the 13 EMA then re-enter. IF you had not exited on the first spike, put your stop loss at breakeven then hold till the EMAs on the RSI have reached the oversold zone.

Price can pull back to the 50 or EMA then give another spike. Just wait for the market to meet our conditions then execute. Close when the 13 EMA crosses the 50 EMA back to the upside.

You need to develop consistency in your trading. You need to have a routine so that you can measure your success as a trader. You may have a sound trading system and always break the rules. If this is the case you will never know how good your system is and how good you are as a trader. Read your plan every day, follow it and you will stay on target with your goals.

You should be calm and relaxed whenever you take trades. This can only be achieved by following your trading routine. The routine will keep your emotions in check. Takes some time to think about what you want to accomplish as a trader. Do you want to trade for a living? What do you want to get out of your trading? Your goals can be personal, use these goals as your motivation in tough times, big boom forex traders.

Make sure you jot down the details of every trade that you take and the reason why you took your trade in your trading journal. You can later on revisit your journal and evaluate your trades to see how you have progressed.

Review your trading plan every time you trade and big boom forex traders to the plan. If you do not have a trading plan on how to use your knowledge you will never be successful. This will shorten your learning curve as you learn from the experts. Read More : Forge Your Own Forex Trading Strategy, big boom forex traders. There are more than five moving averages in the RSI window yet no settings?

No zoom level too!! Incomplete big boom forex traders Save my name, email, and website in this browser for the next time I comment. Attachment The maximum upload file size: 5 MB. You can upload: imageaudiovideodocumentspreadsheetinteractivetextarchiveother. Links to YouTube, Facebook, Twitter and other services inserted in the comment text will be automatically embedded.

Notify me of follow-up comments by email. Press Big boom forex traders to close. This Strategy Can only be applied to Boom and Crash Indicies. It is easy to setup and use. It can be used on both big and small accounts. Share Article:.

boomboom and crashcrashforexforex strategyfree forex strategystrategy. Ghost32 [email protected]. witness on April 27, Elric Arendse on April 27, hamada on April 29, Hello on May 27, Mike on May 29, shehab on June 16, Smith K on July 18, Joelmary on September 2, TRUONGSON DANG on September 7, Ryu on September 11, Leave a Reply Cancel reply Save my name, email, and website big boom forex traders this browser for the next time I comment.

How a Japanese Trader turned $15,000 into $150,000,000

, time: 8:51Forex Boom And Crash Strategy - ForexCracked

11/08/ · For instance, in currency pair trade, using a lot size of for a $ account is a good risk management decision. However, trading boom and crash with a lot size of is a difficult adventure that will demand more than pips before a trader gets a profit of $1. For that reason, blogger.com upgraded the lowest lot size of the market from Estimated Reading Time: 5 mins 26/04/ · How to use the strategy. First, you have to identify where the trend is going in the H1 timeframe. Drop down to the M15 timeframe and draw your supply and demand zones. Now go to the M1 Timeframe. On the M1 timeframe wait for the EMAs in the RSI to get to the Overbought range. Also, wait for the EMA in the RSI to get to the Overbought zone Most currency traders were large multinational corporations, hedge funds or high-net-worth individuals because forex trading required a lot of capital. With help from the internet, a retail market aimed at individual traders has emerged, providing easy access to the foreign exchange markets, either through the banks themselves or brokers making

No comments:

Post a Comment