July 1, it became known that ESMA ceases its temporary ban on marketing, advertising and the sale of “binary options” for retail customers from the European Union. Definitely, this is a mutual reason for joy for both unprofessional traders and trading platforms from the European Union. Advertising, like the most binary options, was inaccessible to ordinary traders with the EU for a long time. The FCA estimates the permanent ban on binary options could save retail consumers up to £17m per year, and may reduce the risk of fraud by unauthorised entities claiming to offer these products. Christopher Woolard, Executive Director of Strategy & Competition at the FCA, said. Mar 17, · Will The ESMA Ban Binary Options. March 17, Last December the ESMA, the European Securities and Markets Authority, shocked traders with news they were planning a blanket ban of all retail binary options trading. If they follow through with this and other proposed rules it could change the face of binary, forex and CFD trading forever.

The ESMA Ban - And How To Continue Trading

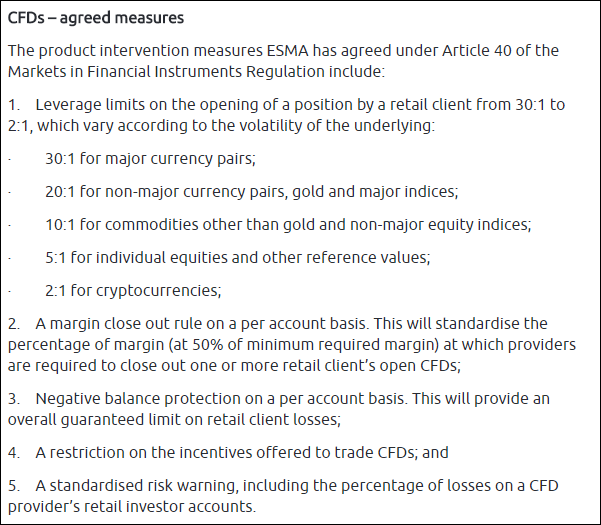

Binary Options - a prohibition on the marketing, distribution or sale of binary options to retail investors; and. Contracts for Differences - a restriction on the marketing, esma binary options ban, distribution or sale of CFDs to retail investors. This restriction consists of: leverage limits on opening positions; a margin close out rule on a per account basis; a negative balance protection on a per account basis; preventing the use esma binary options ban incentives by a CFD provider; and a firm specific risk warning delivered in a standardised way.

Before the end of the three months, ESMA will consider the need to extend the intervention measures for a further three months. This is due to their complexity and lack of transparency; the particular features of CFDs — excessive leverage — and binary options - structural expected negative return and embedded conflict of interest between providers and their clients; the disparity between the expected return and the risk of loss; and issues related to their marketing and distribution.

The new measures on CFDs will for the first time ensure that investors cannot lose more money than they put in, restrict the use of leverage and incentives, esma binary options ban, and provide a risk warning for investors. However, the inherent complexity of the products and their excessive leverage — in the case of CFDs — has resulted in significant losses for retail investors. Leverage limits on the opening of a position by a retail client from toesma binary options ban, which vary according to the volatility of the underlying:.

A margin close out rule on a per account basis. Negative balance protection on a per account basis. This will esma binary options ban an overall guaranteed limit on retail client losses. Frequently Asked Questions. The agreed measures include: 1. Binary Options - a prohibition on the marketing, distribution or sale of binary options to retail investors; and 2.

This will provide an overall guaranteed limit on retail client losses; 4. A restriction on the incentives offered to trade CFDs; and 5. ESMA consults on the impact of algorithmic trading 18 December ESMA publishes cloud outsourcing guidelines 18 December ESMA renews its decision requiring net short position holders esma binary options ban report positions of 0.

Where to Trade Binary options after ESMA BAN in EUROPE UK?

, time: 1:53Ban - How To Avoid The ESMA Ban On Binary Options - blogger.com

The European Securities and Markets Authority (ESMA) has agreed to renew the prohibition of the marketing, distribution or sale of binary options to retail clients, in effect since 2 July , for a further three-month period. ESMA has carefully considered the need to extend the intervention measure currently in effect. The FCA estimates the permanent ban on binary options could save retail consumers up to £17m per year, and may reduce the risk of fraud by unauthorised entities claiming to offer these products. Christopher Woolard, Executive Director of Strategy & Competition at the FCA, said. Dec 24, · ESMA decided to prohibit European brokers from marketing or offering Binary Options to retail investors, effective from July 2nd, This ban will be in place for 3 months, during which time ESMA will be reviewing its effects and will decide whether to extend or to revoke it Last December the ESMA, the European Securities and Markets Authority, shocked traders with news they were planning a blanket ban of all retail binary options .

No comments:

Post a Comment